Widespread, Yet Cautious Optimism for 2021: ARC’s Order Fulfillment Research Findings

Logistics Viewpoints

JULY 7, 2021

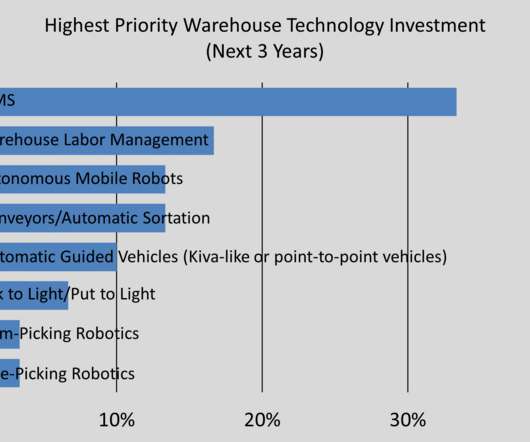

As we enter the second half of 2021, there are abundant signs of improvement and optimization. At the beginning of 2021, ARC Advisory Group, in partnership with DC Velocity magazine, anticipated factors such as a subsequent surge when we crafted our survey of warehouse practitioners. Of course, expectations are uncertain.

Let's personalize your content