Scenario Modeling Is Now Crucial for Supply Chain Network Design

AIMMS

JUNE 16, 2020

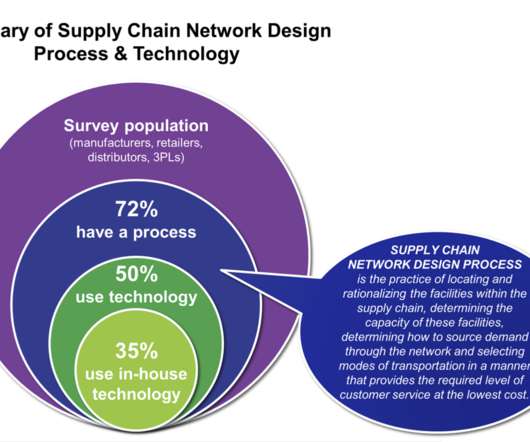

Our 2018- 2019 Network Design Survey showed that the majority of organizations are still relying on spreadsheets (nearly 60%) and gut feel (15%) to make network design decisions. In the context of disruptions like COVID-19, this can make considerable difference , as we’ve seen among AIMMS customers.

Let's personalize your content