A Trillion Dollars in Freight Transactions with Ken Adamo

The Logistics of Logistics

NOVEMBER 5, 2024

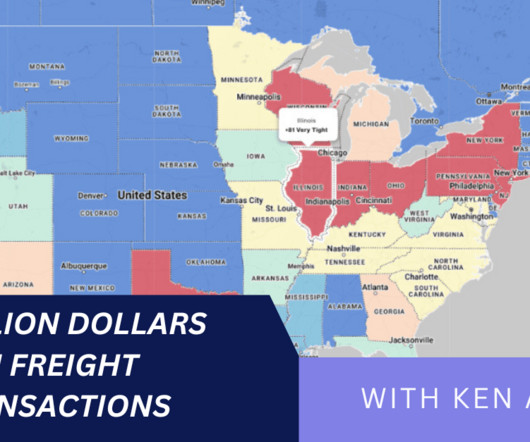

Real-time Market Insights: DAT provides real-time data on spot market rates, capacity availability, and lane-specific trends, enabling informed decision-making. Advanced Analytics Tools: DAT offers sophisticated analytics tools to help users analyze market trends, identify opportunities, and optimize their freight operations.

Let's personalize your content